Integral features are a valuable yet often misunderstood area of capital allowances that can offer substantial tax-saving potential for your business. Our team of capital allowances experts provides clarity on what integral features are, what type of assets qualify and how you can claim tax relief on them.

Capital allowances offer businesses and property investors the opportunity to maximise their tax savings when investing capital in ‘plants and machinery’ and certain assets for their business. By claiming these reliefs against your taxable profits, you can free up cash flow to fuel your business growth. To find out more about what capital allowances are and how you can claim them, read our comprehensive Capital Allowances guide.

One area where your business can utilise capital allowances is by claiming relief on integral features. In this article, we delve deeper into integral features and help you understand the different ways your business can claim capital allowances on these valuable assets.

What are integral features?

Integral features are assets that are classed as the crucial components of a building. They occupy a unique category, falling between “plant and machinery” and “commercial building” expenses. That said, integral features are treated separately from plant and machinery assets as they are subject to a distinct set of rules and rates of capital allowances.

Why were integral features capital allowances introduced?

The concept of capital allowance relief on integral features was introduced in April 2008 (“2008”) for corporation tax and income tax purposes.

Before 2008, assets like cold water and electrical systems were generally excluded from plant and machinery allowances due to specific rules in The Capital Allowances Act 2001 (“CAA01”) CAA01/S.21 & s.22 (except for an exception mentioned in CAA01/S.23 List C, Item 2).

Put simply, the 2008 provisions treated all integral features as if they were part of the plant and machinery category. This change eliminated the need to distinguish between types of cold water and electricity systems, making it easier for businesses to claim the capital allowances they are entitled to.

Which assets qualify as integral features for capital allowances?

CAA01/ s.33A defines integral features as expenditure on the following items:

- Electrical systems, including lighting systems.

- Cold-water systems.

- Space or water heating systems, powered systems of ventilation, air cooling, air purification and related floors or ceilings.

- Lifts, escalators, or moving walkways.

- External solar shading.

In addition, under s104, Cushion Gas, solar panels, certain cars and long-life assets are also included.

Who can claim capital allowances on integral features?

Capital allowances can be claimed by any business undertaking a trade, as well as property businesses, that incurs qualifying expenditure on integral features. This includes sole traders, partnerships, limited companies and other business entities that are subject to income tax or corporation tax.

The eligibility to claim these allowances depends on the nature of the expenditure and whether the assets meet the criteria defined by the Capital Allowances Act 2001, which includes incurring capital expenditure and having an interest in land.

The rules on capital allowances are extremely complex, get in touch with our capital allowances specialists who will be able to answer any questions you have.

How do I claim capital allowances on integral features?

It is crucial to understand how to claim capital allowances on integral features, as the approach you take will significantly impact the tax relief you receive.

The relief available and the amount that can be claimed depends on various factors like whether the assets are new or unused, the purchase date and the availability of specific allowances.

For new and unused integral features, expenditure will attract either:

100% Annual Investment Allowance (AIA)

- The AIA provides 100% tax relief on qualifying plant and machinery expenditure, including integral features.

- The AIA limit is currently set at £1 million. This means you can claim 100% tax relief on the first £1 million of qualifying expenditure in a 12-month period.

50% SR allowance

- The SR allowance was introduced as a temporary measure to boost business investment, alongside the super deduction

- It allows companies to claim a 50% tax deduction on qualifying integral features and other qualifying plant and machinery assets in the year the expenditure is incurred

- The super-deduction is available for expenditure incurred between 1st April 2021 and 31st March 2023.

- Uncapped, unlike AIA.

50% First Year Allowance (FYA)

- The FYA allows companies to claim a 50% tax deduction on qualifying integral features and other qualifying plant and machinery assets.

- The FYA is available for expenditure incurred between 1st April 2023 and 31st March 2026.

Writing Down Allowances (WDA)

- For assets that do not qualify for the AIA, SR allowance, , you can claim WDAs at the rate of 6%.

- In the period following a claim for the SR allowance, you would bring the remaining 50% into account and start claiming WDAs.

Taking a strategic approach to these allowances is crucial in forming a robust claim. A specialist capital allowances professional can advise you on how to do this and in doing so increase the value of your claim.

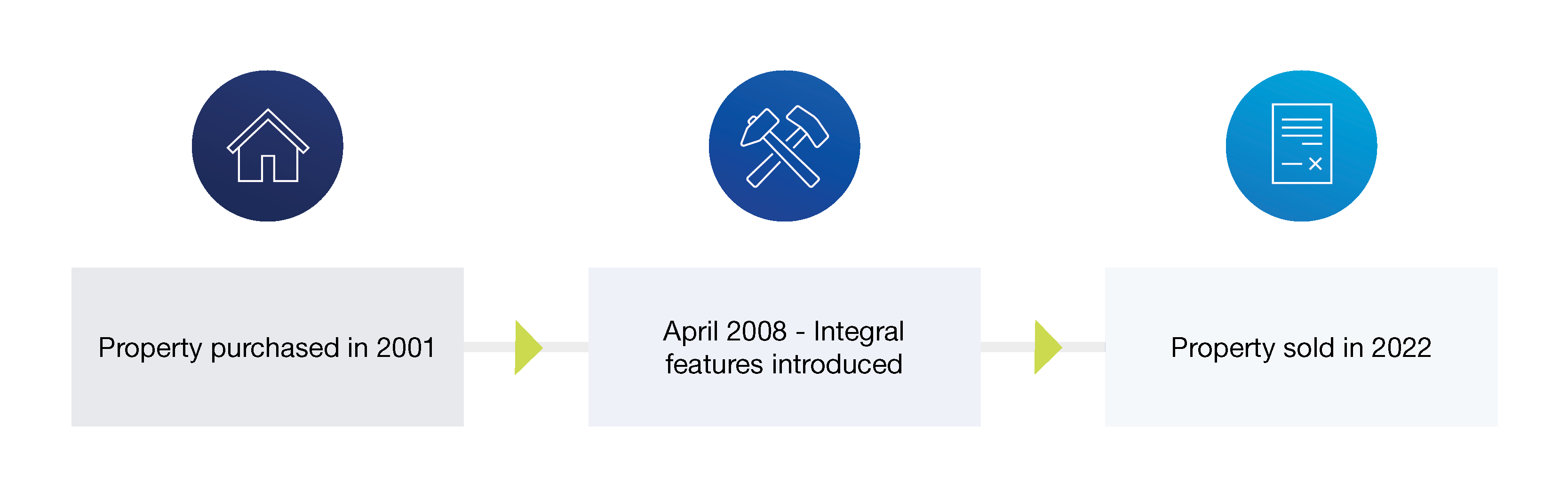

Claiming on integral features for properties owned pre-2008

Claiming capital allowances on properties owned before 2008 differs from post-2008 owned properties because of several reasons such as the new fixtures rules, ownership history and entitlement.

If you purchase a property where the seller acquired it before April 2008, you, as the buyer, could be entitled to an integral features uplift.

As shown above the seller would be unable to claim on the integral features within the property, however, the new buyer could be able to claim submit a claim. This uplift typically amounts to around 15% of the qualifying expenditure. It is an important consideration for buyers, as they can benefit from being the beneficiary of the integral features, leading to potential tax savings and enhanced financial efficiency in managing the property.

As shown above the seller would be unable to claim on the integral features within the property, however, the new buyer could be able to claim submit a claim. This uplift typically amounts to around 15% of the qualifying expenditure. It is an important consideration for buyers, as they can benefit from being the beneficiary of the integral features, leading to potential tax savings and enhanced financial efficiency in managing the property.

Maximise your claims with specialist capital allowances advice

Claiming capital allowances on integral features can reduce your tax burden and improve your financial position. To ensure you receive the maximum tax relief, it is crucial to use the right combination of allowances based on your business’ specific situation.

Our capital allowances specialists at PKF Smith Cooper are here to guide you through the intricacies of this complex tax system and help you identify the best approach for your business.

Contact us today and unlock the full potential of your capital allowances claims.