2024/25 Tax card – Key rates and allowances

Our 2024/25 tax card covers the key tax rates and allowances relevant to both you and your business.

The information included in our 2024/25 tax card reflects changes announced by Jeremy Hunt in his Spring Budget, and is a valuable point of reference throughout the tax year. It also includes useful supplementary explanations as well as the 2023/24 tax rates so you can see the changes.

Download your copy below, or for more information about how our team can help guide you through the rates and allowances, the process of claiming them and advise on specific situations, get in touch.

Download the PDF2023 Annual deals review

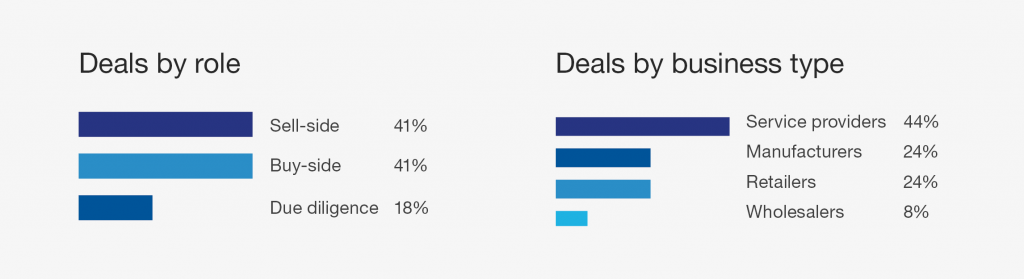

PKF gained market share in deal activity as we ranked 5th most active in the Midlands and 7th nationally. Our team once again delivered a high level of M&A activity, against an uncertain economic and political backdrop.

We pride ourselves on deal creation rather than simply executing transactions. In 2023 PKFSC Corporate Finance completed 22 deals worth a combined total of £277m in what has been a challenging market. Our high completion rate reflects the time and effort we put into identifying the right deals for clients and finding creative solutions when issues arise.

Key highlights of the year include:

- Finding the right home for 9 businesses by selling to strategic acquirers;

- Facilitating 4 Management Buyouts;

- Providing acquisition support including private equity bolt on acquisitions;

- Fundraising for a number of our deals;

- Sale to employee ownership trusts; and

- Developing our financial due diligence offering

Over the past year, we have continued to invest and grow our advisory team. Josh Gurton was recognised for his invaluable contribution to deal efforts with a second promotion in six months. We also invested in two new recruits, Callum Leslie and Lauryn Mayson, strengthening our formidable dealmaking team.

We have also been investing in our financial due diligence capabilities with Deniss Sipovics being promoted to manager – a testament to the team’s growing expertise and experience.

Whilst we have international capabilities, we continued to fuel M&A activity on home soil, completing 20 deals in the Midlands and helping business owners across the Midlands achieve their goals and objectives. Drawing on our global reach and access to international purchasers, we completed a number of cross-border deals.

Additionally, our team remain creative and ready to explore a number of potential liquidity events for shareholders. For award-winning technology consultancy Griffiths Waite, an employee ownership trust provided the optimal solution, demonstrating our team’s ability to investigate different options with business owners and identify the best solution to meet their objectives.

The year ended on a high with our Midlands team completing four deals in just two weeks, evidencing that, even in challenging market conditions, the appetite for M&A among high quality businesses remains strong.

Sectors

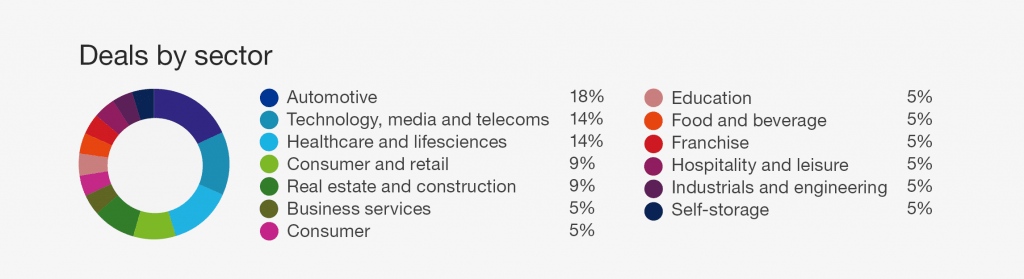

This year our top sectors were Automotive and Technology, Media and Telecoms.

The Automotive sector was strong across the retail, distribution and aftermarket segments. We supported on transactions involving passenger-vehicle and commercial-vehicle dealerships, vehicle hire and rental businesses as well as suppliers and aftermarket services.

In the last 3 years PKF has completed over 100 deals in the broad technology sectors and we continued to build-upon this expertise with transactions in enterprise software, retail-tech and health-tech.

Despite a challenging year for self-storage, which was characterised by tougher trading and instability caused by interest rates and the housing market, we were able to continue to unlock transactions such as Quick Self Storage’s acquisition of Prime Self Storage.

We continued to have deep involvement in the Franchise and Food and Beverage sectors and expect to deliver a number of deals this year.

Outlook for 2024

Could 2024 be the year of the mid-market? Dealmaking levels in the UK are expected to rebound from 2023 levels as uncertainties around inflation, interest rates, as well as political and macro concerns, ease. Despite a more cautious view from corporates and traditional lenders stifling activity, the ingredients underpinning M&A activity remain in place, with alternative funders and increased activity from PE and their portfolio companies supporting the market in 2024.

At PKF Corporate Finance, we anticipate activity in the mid-market to remain robust and we have recruited more personnel to support our anticipated increased deal activity over the coming months. We have exciting plans to expand our team.

If you’d like further information regarding the contents of this document, or you’d like to find out more about how we can help you and your business, please get in touch.

Download the PDF2023/24 Year-end tax planning guide

The run up to the end of the tax year on 5 April 2024 is a good time to make sure that your family and business finances are arranged in the best way possible.

Each year brings its own tax challenges, and this year is no exception. Although the Autumn Statement 2023 was low on dramatic announcements, there are a number of important changes pre-dating this, which will take effect shortly. These will merit consideration as part of a year end review for many people, and include:

- further reduction to the capital gains tax annual exempt amount

- a further cut in the Dividend Allowance

- the introduction of basis period reform for unincorporated businesses.

In this briefing, please note that we use the rates and allowances for 2023/24 and the term spouse includes a registered civil partner.

Tax rates and allowances

Income tax rates and bands for 2023/24 are determined by which part of the UK you live in, and what type of income you have.

Rates and bands: English, Welsh and Northern Irish taxpayers 2023/24

| Taxable income | Non-savings and savings income rate | Dividend rate |

| £0 to £37,700 | 20% | 8.75% |

| £37,701 to £125,140 | 40% | 33.75% |

| Above £125,140 | 45% | 39.35% |

Taxable income is income in excess of the personal allowance. Non-savings income is broadly earnings, pensions, trading profits and property income.

Rates and bands: Scottish taxpayers 2023/24

| Taxable (non-savings) income | Band | Rate |

| £0 to £2,162 | Starter | 19% |

| £2,163 to £13,118 | Basic | 20% |

| £13,119 to £31,092 | Intermediate | 21% |

| £31,093 to £125,140 | Higher | 42% |

| Over £125,140 | Top | 47% |

Scottish taxpayers continue to pay tax on their savings and dividend income using the UK rates and bands.

Looking to the future, the position is set to become increasingly different for Scottish taxpayers, as underlined by the Scottish Budget proposals for 2024/25. If passed, these increase the Starter and Basic rate tax thresholds for those entitled to the standard personal allowance, so that they become £14,876 and £26,561 respectively. The Starter, Basic, Intermediate and Higher rates are to remain unchanged, as are the Higher rate threshold and Top rate threshold.

From 6 April 2024 there will be a new 45% Advanced rate of tax, applying to income over £75,000 and bringing the total of Scottish income tax bands to six. Finally, the Top rate of tax increases to 48% for income over £125,140.

The personal allowance

In principle, everyone is entitled to a basic personal allowance before any income tax is paid. This means that many people pay no income tax on the first £12,570 of income received. The personal allowance can be higher if you are eligible for the Blind Person’s Allowance. It is reduced for those with higher levels of income. Where an individual’s adjusted net income is more than £100,000, the personal allowance is reduced. It falls by £1 for every £2 of income above that limit, and by the time income reaches £125,140 or more, all personal allowance is lost. Timely planning can, however, delay the point at which this happens, or in some cases, mean the allowance is kept in its entirety.

Tip: Can you retain the personal allowance?

Adjusted net income, broadly speaking, is total taxable income before personal allowances, but after some deductions such as pension contributions and Gift Aid. If you are in the £100,000 to £125,140 income bracket, additional pension contributions or payments under Gift Aid, can help preserve the personal allowance.

The Savings and Dividend allowances

In some circumstances, you may be entitled to the Savings Allowance, with savings income within the allowance taxed at 0%. The amount of the allowance depends on your marginal rate of tax: that is the highest rate of tax to which you are subject. Basic rate taxpayers have a Savings Allowance of £1,000. Higher rate taxpayers have a Savings Allowance of £500. Additional rate taxpayers do not receive the Savings Allowance. The Dividend Allowance is available to all taxpayers, regardless of their marginal tax rate. This charges the first £1,000 of dividends to tax at 0%.

Savings and dividends received above these allowances are taxed at the rates shown in the table. Savings and dividends within the Savings Allowance or Dividend Allowance still count towards an individual’s basic or higher rate band. They may thus impact the rate of tax payable on income in excess of the allowances.

Some taxpayers may also be entitled to the starting rate for savings. This taxes £5,000 of interest income at 0%. This rate is not available if non-savings income is more than £5,000.

Tip: Dividend Allowance is more generous before April 2024

The Dividend Allowance falls to £500 from 6 April 2024, but until then, it is £1,000. Dividend payment before 6 April 2024 gives access to the higher limit for 2023/24.

Tax and the family

Make full use of bands and allowances

The incomes of married couples and civil partners are taxed separately. Each spouse or partner has their own personal allowance. In addition, married couple’s allowance is available if one party was born before 6 April 1935. There is also what is called the ‘marriage allowance’, a transferable allowance that potentially makes £1,260 of the personal allowance of one party available to the other in certain circumstances. The donor’s income must normally be below the personal allowance for this to be beneficial.

Where each party is in a different tax band, making sure that income is distributed appropriately is key. Optimally, the personal allowance of the lower income spouse should be used in full, and full advantage taken of access to lower tax bands. It may be beneficial to transfer income-producing assets, such as property, stocks and shares, or even bank accounts to do this. It is always important to make sure that any transfer is an outright gift, and that the donor no longer exerts control over, or derives any benefit from it. Evidence of such transfer is also required. Please do talk to us prior to any action, to make sure that arrangements are effective and do not inadvertently fall the wrong side of any anti-avoidance legislation.

Children are treated independently for tax purposes. They have their own personal allowance, annual capital gains tax (CGT) exemption and their own basic rate tax band and savings band.

Tip: who should help?

From a tax point of view, it is usually more efficient for grandparents, rather than parents, to provide funds for investment for under-age children.

Involve family in the business

For family companies and unincorporated businesses alike, involving family members and remunerating them appropriately is usually very beneficial. It can be a good way to multiply the opportunities to extract profits before hitting higher rates of tax, or where a spouse or child is unlikely to use their personal allowance, for example. But involvement must be a practical and commercial reality, and you must be able to evidence that family members genuinely work in the business. Remuneration must be incurred wholly and exclusively for the purpose of the trade, and could be challenged if considered excessive by HMRC.

Tip: pension planning in family companies

Pension contributions remain a highly efficient way for director-shareholders to extract profits. Pension contributions are deductible expenses for corporation tax purposes, so long as they are wholly and exclusively for the purposes of the trade, and where a spouse is employed by the company, the company can also make reasonable contributions on their behalf. So long as the remuneration package is justifiable, the company should be able to claim tax relief for these.

Note new CGT rules for separating couples

Transfers of assets between spouses can usually be made on a no gain/no loss basis for CGT purposes. But where spouses are in the process of separating, the rules are different. Until recently, the window in which such transfers could be made lasted only until the end of the tax year of separation. After that, transfers were treated as normal disposals for CGT purposes.

This has changed, so that for transfers on or after 6 April 2023, there are now up to three years after the tax year in which spouses cease to live together to make no gain/no loss transfers; and unlimited time if the assets are the subject of a formal divorce agreement. There are also special rules covering the position where someone has a financial interest in the former family home after separation, that apply when the home is sold.

Watch for Child Benefit charge

The High Income Child Benefit Charge (HICBC) is still something many people are unaware of. It applies where one of a couple gets Child Benefit, and either one or both partners has adjusted net income in excess of £50,000. Partner for these purposes includes someone you live with as if you were married, as well as spouse or civil partner. If both parties are over the income threshold, the charge is the responsibility of the higher earner.

The charge claws back Child Benefit at a rate of 1% for every £100 of income between £50,000 and £60,000. By the time income is £60,000, Child Benefit is withdrawn in full.

The government has said it intends to change the way that HICBC is administered and collected, so that those liable to pay can do so through their PAYE tax code. At present, however, taxpayers need to register for self assessment, and it’s the taxpayer who is expected to be proactive, and notify HMRC of their liability to pay the charge. There is an obligation to notify once adjusted net income is more than £50,000. In some cases, HMRC may make contact or send a nudge letter if it thinks someone is due to pay, but this does not happen automatically.

Family companies: assess profit extraction strategy

There’s a changing outlook for director-shareholders in family companies. Recent developments, such as the change to the Dividend Allowance and National Insurance contribution (NICs) rates; and potentially higher corporation tax rates, all mean remuneration may need rethinking. Checking the numbers in your own particular circumstances becomes increasingly important.

Corporation tax

The main rate of corporation tax is 25% for companies with profits of more than £250,000. A small profits rate of 19% applies to profits of £50,000 or below. Where profits are between the two, corporation tax is paid at the main rate reduced by marginal relief. This provides a gradual increase in the effective corporation tax rate. In all, higher corporation tax rates and marginal relief may mean new choices for profit extraction.

Tax efficient remuneration

Traditional remuneration strategy involves a small salary, and extracting remaining profits as dividends.

Salary: this is usually set at a level sufficient to qualify for state benefits (notably State Pension entitlement) but pitched so that no liability for NICs arises. Salary counts as a deductible business expense for corporation tax purposes, as do employer NICs. Unless a director has a contract of employment that means they are a ‘worker’, there is no need to pay minimum wage hourly rates.

For 2023/24, the preferred salary in many cases will be £12,570, so that the standard personal allowance is fully used. NICs for directors are calculated based on an annual earnings period on salary and bonuses. Though employer NICs kick in at £9,100, employee NICs are due on earnings over £12,570, with a further 2% charged above the upper earnings limit of £50,270. We can help you review an appropriate figure for salary to suit your circumstances.

Dividends: The Dividend Allowance continues to fall, whilst the rate of tax on dividend income has become higher. This means that extraction of profits through dividend payment has become more expensive. Whilst in many cases, it may still be tax efficient to take profits as dividends rather than salary, the decision is becoming more nuanced.

Bonus: In some cases, it may be more efficient to extract profit as a bonus, for example where there are not sufficient retained profits out of which to pay a dividend at the required level, or where corporation tax is paid at the full rate.

Like salary, bonuses are subject to income tax and NICs for the director, and employer NICs for the company. The cut to employee Class 1 NICs from 12% to 10% from 6 January 2024, will make payment of a bonus less expensive. The full effect of the reduction will only be felt from 6 April 2024. For 2023/24, directors will pay a ‘blended’ annualised NICs rate of 11.5%.

The rules around timing can sometimes be used to advantage. For corporation tax, bonuses can be decided after the end of the company year, when final results are known provided that there is an obligation in place at the year end. They are still deductible in that year if paid within nine months. For income tax, there is scope to defer taxation of a bonus into a later tax year, or include in the current tax year, depending on how and when the bonus is declared. It is important to get the timing and procedure correct, and we can advise further.

Consider how to deal with directors’ loans

It is common for director-shareholders in family companies to have a loan account with the company. As most family companies are what are technically called ‘close companies’, this brings them within scope of the ‘loans to participator’ rules. This can mean a charge to corporation tax, often known as a s455 charge, if a director’s loan account is unpaid nine months after the end of the accounting period. For loans made on or after 6 April 2022, the charge is 33.75%.

Please do talk to us about the options for dealing with a director’s loan in your circumstances.

Savings and investments

Individual Savings Accounts: act by 5 April

Individual Savings Accounts (ISAs) are free of income tax and capital gains tax, and do not impact the availability of the Savings or Dividend Allowances. Although ISA limits have not increased this year, the tax benefits continue to be attractive.

There are four types of ISA: cash ISAs, stocks and shares ISAs, innovative finance ISAs and lifetime ISAs.

The lifetime ISA can be used to buy a first home or save for later life. Funds are topped up by the government, which adds a 25% bonus, up to a maximum of £1,000 per year. After the age of 50, no payment into the ISA is allowed, and government top ups cease. Money can be withdrawn to buy a first home, on reaching age 60 or over, or if someone is terminally ill and has less than 12 months to live. In other circumstances, a withdrawal charge of 25% applies.

Rules and changes

The total that someone can invest in any tax year is set by the government. The limit has not changed for some years: the junior ISA limit is £9,000, and the limit for adults remains £20,000. The overall limit can be allocated across the various types of ISA available.

At present, it is only possible to subscribe to one of each type of ISA each year, but from 6 April 2024, multiple ISAs of the same type will be allowed each year, subject to the overall £20,000 limit. The exception to this is the Lifetime ISA. The limit here is £4,000.

Autumn Statement 2023 also announced some changes to the detail intended to widen the scope of investments permitted within Innovative Finance ISAs. These also take effect from 6 April 2024.

Anyone over the age of 18, who is resident in the UK can open an ISA. In the case of Lifetime ISAs, the applicant must also be under the age of 40. Crown servants and their spouses not living in the UK are also eligible. Junior ISAs are available for children under 18.

Until 6 April 2024, cash ISAs can be opened at the age of 16. From 6 April 2024, this changes, and applicants will have to be 18.

You cannot hold an ISA with anyone else: there is no facility for a joint ISA for spouses. You and your spouse have individual subscription limits, meaning that as a household you can invest a maximum of £40,000. Although you cannot hold an ISA on behalf of someone else, you can open and manage an ISA for someone in vulnerable circumstances, where they lack the mental capacity to do this for themselves. This can be done by applying to the Court of Protection for a financial deputyship order. In Scotland, application is to the Office of the Public Guardian in Scotland.

Tip: Act by 5 April

We recommend taking stock of your position before 5 April 2024. ISA limits can’t be carried forward into future years and are lost if not used in the tax year.

Consider the venture capital schemes

Generous tax incentives exist to reward individual investors in young, higher risk companies not listed on a recognised stock exchange, which would otherwise struggle to access finance.

There are three ways to access such relief: by investing through the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS) and through Venture Capital Trusts (VCTs). Where the EIS and VCT rules contained sunset clauses, limiting tax relief to shares issued before 6 April 2025, recent legislation has now extended the operation of the schemes. This means that income tax and capital gains tax reliefs for investors in new shares issued before 6 April 2035 will continue to be available.

The potential for tax relief is considerable. With SEIS, for example, a qualifying investor can invest up to £200,000 in qualifying companies in a tax year, receiving income tax relief of up to 50% of the sum invested. Where shares are sold more than three years after the date on which issued, any resulting gain is also free of CGT. With EIS and VCTs, income tax relief of 30% is currently available on subscriptions for shares. There is also favourable capital gains treatment.

Obviously, this is a high-level overview, and close attention to the detail of the rules is needed. Please do talk to us for further details.

Keep up to date with pension planning opportunities

It’s been a year of significant change for pensions, with developments impacting high earners and workers over 50, in particular.

- From 6 April 2023, the Annual Allowance (AA), increased from £40,000 to £60,000. The AA is the maximum tax-relieved pension saving that can be made each year without attracting a tax charge.

- Change around limits for the tapered AA. From 6 April 2023, the tapered AA applies where adjusted income (broadly net income plus employer pension input) is more than £260,000 (up from £240,000) and threshold income (broadly net income less pension contributions) is more than £200,000. For every £2 of adjusted income above £260,000, the AA is tapered by £1, until it reaches a specified minimum.

- From 6 April 2023, the minimum tapered allowance is £10,000, rather than £4,000.

- From 6 April 2023, the Money Purchase Annual Allowance is £10,000, rather than £4,000. This lower AA applies where someone has flexibly accessed a defined contribution pension.

- The Lifetime Allowance (LTA) charge was abolished from 6 April 2023, and the LTA itself is abolished from April 2024. The LTA has capped the total amount that could be built up in tax-relieved pensions savings. Until 5 April 2023, it was, in most cases, £1,073,100, though a higher limit applied where there was LTA protection.

- Excess lump sums above the LTA are now taxed at the marginal rate of income tax, (rather than a 55% tax charge).

- The Pension Commencement Lump Sum (the maximum tax free payment available on first accessing pension benefits) is now set at £268,275, except where protections apply.

Whilst welcome news, the tax position of high earners continues to be complex, and we would recommend reviewing the position on an individual basis. It is worth mentioning that pension planning for Scottish taxpayers can only become more significant with change to Scottish income tax rates and bands projected from 6 April 2024.

Making pension contributions remains one of the most tax efficient ways to invest for your future. Whether you are a director-shareholder, self-employed business person or partner, we would be happy to discuss this area with you further.

Take stock of capital gains tax rules and changes

Capital gains tax (CGT) is charged at 10% (18% on residential property) for UK basic rate taxpayers; and 20% (28% on residential property) for UK higher and additional rate taxpayers. Scottish taxpayers pay CGT based on UK rates and bands, and therefore need to assess their position based on UK rates.

Maximise potential of annual exemption

The CGT annual exemption is set to fall to a new low this year, as announced in the Autumn Statement 2022. From 6 April 2024, the exemption is £3,000, rather than £6,000. Government figures suggest that by 2024/25, more than a quarter of a million more individuals and trusts will be within scope of CGT for the first time as a result. The change makes tax efficiency all the more important.

Each individual has their own annual exemption, so for couples, it makes sense to ensure that each party makes full use of this. In some circumstances, this may be achieved by transferring assets between you. Spouses (but not cohabiting couples) can usually transfer assets between them on a no gain/no loss basis for capital gains purposes. Where one spouse is a higher rate taxpayer, and the other has not made full use of their basic rate band, for instance, a transfer of assets has the potential to give access to the 10% tax rate, rather than the 20% tax rate. It is important that any transfer is outright and unconditional: do please talk to us beforehand to make sure your transfer is effective for tax purposes.

Review position for family home

If you sell a home that has always been your main or only residence for all the time that you have owned it, any gain should be covered by CGT Private Residence Relief (PRR). There are qualifying conditions for PRR: eligibility assumes, broadly, that the house is not let out; that no part of the home is used exclusively for business purposes; that the grounds, including all buildings, do not exceed 5,000 square metres in total; and that it was not purchased in order to make a gain.

The position is not always straightforward, however. Where, for example, a delay in selling means a property is let out and another purchased before the first is disposed of, the capital gains position can become complicated quite quickly.

Change in the last few years has reduced what is called ‘final period exemption’, which gives PRR for a specified period, even if someone is not living in the property. For property sold prior to 6 April 2020, this covered the final 18 months of ownership. Now it is only available for the final nine months of ownership. There are different provisions for someone who is disabled or in long-term residential care, and here PRR extends to the final 36 months of ownership.

Finally, it may be helpful to be aware that HMRC does sometimes challenge the availability of PRR. ‘Residence’ is not defined in the legislation. HMRC isn’t simply looking at how long a property is occupied. It’s looking for a ‘degree of permanence, continuity and the expectation of continuity’ to establish that a dwelling is being used as a residence, and what it calls the ‘quality’ of occupation is generally very important here. This extends to factors like sitting down for a meal, doing laundry and spending leisure time at a property.

Tip: More than one home?

Married couples can only count one property as their main residence for CGT purposes. This can be problematic if both parties are homeowners. In this situation, it’s possible to decide which of the two properties you wish to nominate as your main residence and notify HMRC of this. We can advise further.

Be aware of rules on cryptoassets

HMRC is increasingly on the look out for income and gains made from cryptoassets. Spring Budget 2023 announced that the design of the self assessment tax return is to be adapted to reflect this. From 2024/25, the capital gains tax pages will specifically ask for information on income and gains from crypto transactions.

The buying and selling of cryptoassets is usually treated as a personal investment, bringing it within the CGT regime. With the CGT annual exemption falling, it will become more important to monitor any crypto transactions you may make.

Latest developments

HMRC has recently launched a new service to allow someone to voluntarily disclose any unpaid tax on income or gains from cryptoassets, including exchange tokens, such as bitcoin, non-fungible tokens and utility tokens. The service is essentially designed to bring someone’s affairs up to date where transactions giving rise to capital gains were made in the past, rather than in the current tax year. We would always recommend professional advice before using HMRC disclosure facilities like this.

Use Gift Aid effectively

As well as providing a benefit to the charity or Community Amateur Sports Club (CASC) of your choice, donations under the Gift Aid scheme can provide a useful planning tool for donors.

Use Gift Aid to reduce taxable income

Payments under Gift Aid impact the calculation of your taxable income. This means they have the potential to keep income under key thresholds:

- High Income Child Benefit Charge (HICBC). For HICBC, clawback of Child Benefit payment begins where one of the couple has income over £50,000.

- Abatement of the personal allowance. If someone has adjusted net income more than £100,000, the personal allowance is tapered, and lost at the rate of £1 for every £2 over £100,000. If adjusted net income is £125,140 or more, the personal allowance is nil.

- Additional rate threshold in England, Wales and Northern Ireland: additional rate is charged on income over £125,140.

- Top rate threshold in Scotland: Top rate is charged on income over £125,140. From 6 April 2024, there will also be an Advanced rate of tax in Scotland, charged on income over £75,000 to £125,140.

Where income is close to any of these limits, a payment under Gift Aid could be very tax efficient.

Use flexibility on timing of relief

A carry back election can be made, meaning Gift Aid donations are treated as if made in the previous tax year. This can be of benefit where, for example, income is uneven; if perhaps you paid tax at a higher rate in the previous year. But there are strict time limits and procedures. A claim must be made on or before the date that the tax return for the previous year is filed; and not later than 31 January in the tax year that the gift was made. The claim must be made in the tax return: it cannot be made in an amended return. This means that the chance to make a carry back election is lost once a return is filed.

Tip: paying tax at more than basic rate?

Did you know that if you pay tax at more than basic rate, a payment under Gift Aid should result in a tax refund? This is because you are entitled to tax relief at your top rate of tax on the donation. This means you get the difference between the basic rate tax paid on the donation, and higher rate tax on the donation.

Take advantage of higher rate relief

Higher rate relief goes unclaimed by many donors. A repayment claim is made either via the self assessment tax return, or by asking HMRC to amend the tax code.

To make a claim, there should be a valid Gift Aid declaration in place for all gifts made. To back up the claim, appropriate records should be kept. These should comprise the date; amount of each gift; and the name of the recipient charity.

Take stock of new restriction

As part of the post-Brexit rearrangements, the government announced in the Spring Budget 2023 that tax reliefs and exemptions for charities were to be restricted to UK charities and CASCs. EU and European Economic Area (EEA) charities registered with HMRC for tax reliefs and exemptions at that date, however, have had a transitional period in which to continue claiming relief. This ends on 5 April 2024. The move means that money from UK taxpayers is used to support UK charities only. If you have previously supported charities in the EU or EEA, or perhaps have made provision for such a charity in the terms of your will, the position may need reassessing.

Here to help

Getting the tax relief right on charitable giving can be complex. We should be happy to advise further, especially where a carry back election may be of benefit.

Unincorporated businesses: plan for major change

Basis period reform

From 6 April 2024, there is a change to the way that business trading income is allocated to tax years for income tax purposes: ‘basis period reform’. This means that businesses are taxed on the profits arising in the tax year, rather than their accounting year. It impacts only unincorporated businesses — the self-employed and partnerships — and within these groups, it only affects those that do not use a 31 March or 5 April year end. It does not impact companies.

In the long run, the change is meant to mesh in with the Making Tax Digital for income tax programme, and provide a better digital experience. In the short run, for many businesses, it will accelerate the tax liability. The 2023/24 tax calculation for businesses not using 31 March or 5 April year end will be based on a longer period than usual: profits to the end of the normal accounting period, plus a proportion of profits from the end of the accounting year to 5 April 2024. Provisions exist to minimise the impact, by using overlap relief (where available), and spreading the ‘additional’ profits over five years. However, the change is still likely to mean higher tax bills in 2023/24 and following four years. There are also associated changes that will be needed to prepare yearly accounts and tax returns.

Tip: planning to minimise impact

For some businesses, the solution will be to change the accounting year end to 31 March; though this will not be an option for every business. It may not be viable for seasonal businesses, or those with international reporting requirements, such as large professional partnerships, for example.

The consequences of basis period reform will vary depending on your circumstances. We will be pleased to help you take stock of the position now, looking at the effect on cash flow, checking any possibility of being pushed into higher bands of income tax, and advising on damage limitation strategies where appropriate.

This guide will help identify areas that could significantly impact your overall tax position, but advice specific to your circumstances is always recommended. Our tax services team are on hand to help you plan a tailored, tax-efficient approach to every aspect of your business and personal life. Please contact us well in advance of 5 April 2024 to make the most of the options available.

Download the PDFCharity news update – Autumn 2023

Inside this edition

Charity use of social media

Social media is rarely out of the news these days, often with adverse consequences for those who have misused it or failed to take proper precautions over its use. The charity sector has not been immune to this, with the RSPB being the centre of a political row after a tweet it published accused Government ministers of being liars, for which the RSPB chief executive had to subsequently apologise for.

It is timely therefore that CCEW has recently published guidance on the use of social media by charities. They acknowledge that there are many benefits to be gained from using social media, from raising awareness when campaigning, fundraising or advertising for employees and volunteers. The guidance makes clear that charities are entitled to campaign online in support of their objectives and beneficiaries, and shouldn’t be afraid to engage in activity in sensitive areas such as immigration, even though it risks triggering controversy. The guidance does not change the position that a charity cannot support or oppose a particular political party, but it does make clear that the law permits charities to undertake political activity in support of their charitable aims.

The CCEW has identified that there is a knowledge gap, and that charities and trustees are not always aware of the risks that may arise from using social media. The guidance aims to fill that gap to help trustees understand those risks and how their legal duties apply.

The key messages from the guidance are:

- Although trustees may not be involved in the day-to-day running of their charity’s social media, they must understand their legal responsibilities when delegating tasks.

- Charities should have in place a social media policy that sets out how the use of social media will further the charity’s purpose, and include guidelines for those that use social media on the charity’s behalf. The guidance has a checklist that can help in formulating that policy.

- Guidelines should also be put in place to manage the risk that content posted by individuals connected to the charity in their personal capacity may have a negative impact on the charity by association, although it is acknowledged that individuals have a right to exercise their freedom of expression within the law.

The guidance also includes details of organisations and resources that can help charities and trustees to improve their social media skills.

Guidance: https://bit.ly/3PS2UHt

The state of the charity sector

Over the summer a number of reports have been issued providing an indication of the state of the charity sector in 2023 after the difficulties of the last few years caused by the pandemic and subsequent cost of living crisis.

In July CCEW published two reports based on research carried out earlier this year. The first addressed public trust in charities, and concluded that this had marginally increased at a time when other institutions have not fared so well. This stability is to be welcomed, but levels of trust still remain well below the levels seen before 2015 when a number of scandals rocked the public’s perception of the sector. It is notable that trust levels are highest with smaller, local, volunteer-run charities than for many of the larger household names, often as those smaller charities are easier to identify with and can demonstrate a clearer link between donations and impact. It is clear that a charity that demonstrates transparency, whose work is more readily understood and supported, is one that is more likely to be trusted. Based on this research key issues for the sector for charities to consider include the need to manage funds responsibly, avoid unnecessary risks and to demonstrate how they make a difference.

CCEW’s second report was based on research carried out with trustees and showed that most are of the opinion that they understand public expectations around finances, impact and values. There is work to be done though by smaller charities in promoting greater inclusivity at board level, with recruitment and retention policies needing to adapt and reflect modern expectations as to how charities should be governed.

Both the public and trustees had broadly similar views on the role of CCEW and the need to balance providing support for the sector and dealing with wrongdoing.

In the same month NCVO published a report entitled Time Well Spent, looking at what volunteer participation and experience currently looks like. It noted a fall in formal volunteer participation in recent years including in connection with fundraising activities, something the pandemic is likely to be the cause of. It was noted though that there was a growing trend in volunteering remotely.

For charities seeking to recruit more volunteers knowing what motivates them will be beneficial, with the need to feel that they are making a difference noted as the most important aspect of volunteering, followed closely by not being made to feel pressured to give time. The report goes on to provide a wealth of data on volunteer experience and impact, barriers to volunteering and retention issues that may provide insights for charities on how to best manage their volunteers on which many charities rely.

Details: https://bit.ly/45Vge3f and https://bit.ly/48qfV25

Investment policy

CCEW has issued revised guidance on Investments following a recent consultation, bringing it up to date for the modern era and ensuring that it reflects recent legal developments such as the recent High Court judgement in the Butler-Sloss case. This guidance is set out in CC14 Investing charity money: guidance for trustees.

The key theme of the guidance is the need for trustees to adopt a responsible investment strategy, acknowledging that trustees have discretion to choose what is best in their circumstances and that they have a range of investment options available. Maximising investment return remains something for trustees to aim for, but not at the expense of compromising the charity’s purposes as ultimately the need to further those purposes should underpin all of the charity’s decision making.

To assist trustees the guidance provides examples of issues for trustees to consider when setting an investment policy, such as the potential for an investment to conflict with the purposes of the charity, or the reputational risk of an investment decision. In doing so it warns trustees from allowing personal motives, opinions or interests to affect the decisions they make. The guidance also makes clear what actions trustees must take in order to be compliant with the law, such as when independent advice should be taken, and what is recommended best practice.

The updated guidance also includes advice on the use of social investments that are used to achieve the charity’s purposes directly through the investment as well as making a financial return, and the different considerations that would apply.

Trustees of charities that make investments of any kind should familiarise themselves with this updated guidance and ensure that through its use they are able to justify that the investment decisions they make are in their charity’s best interests.

Guidance: https://bit.ly/3ZuUEQC

Charity law reform – England & Wales

In our last edition we reported on the reforms set out in the Charities Act 2022 that were due to take effect in the Spring. At the time there was a delay in introducing the changes and we were unable to confirm the date that they took effect from, but we can now confirm that it was 14 June 2023. CCEW has now ensured that its guidance material has been updated for these legislative changes, which covered the following areas:

- Selling, leasing or otherwise disposing of land

- Using permanent endowment

- Charity names

It is anticipated that the following principal changes will come into effect for charities located in England and Wales before the end of 2023.

Charity constitutions

Reforms are being introduced to harmonise the rules on making changes to a charity’s governing documents, which currently differ depending on whether a charity is unincorporated, a CIO or a limited company.

Charity trustees

CCEW will have new powers to order a charity to pay charity trustees for work they have performed if it would be unfair for them not to be paid, avoiding the current need for a charity to go to Court to authorise these payments or benefits.

CCEW will also be able to ratify the appointment of a charity trustee where it is unclear whether they were properly appointed in the first place.

Charity mergers

Reforms will be implemented that address some technical issues that can arise when dealing with legacies to a charity that has merged with another institution where details of the merger have been entered in CCEW’s Register of Mergers.

This will only then leave the reform of ex gratia payments that was included in the 2022 Act which remain under consideration with no date yet announced of what they are expected to come into effect.

Guidance: https://bit.ly/3BTKIoB

Charity law reform – Scotland

In the last edition of Charity News we reported on planned reform of charity law in Scotland. On 9 August 2023 the Charities (Regulation and Administration)(Scotland) Act 2023 became law. The new law aims to promote greater transparency and accountability of charities and their trustees, and will introduce some changes that will bring Scotland into line with charity regulation already seen elsewhere in the UK.

The principal changes being introduced by this legislation are as follows:

Scottish Charity Register

The amount of information published on the publicly accessible register will be expanded. For the first time the names of a charity’s trustees will be shown, although in special circumstances such as where there is a risk to personal safety charities can request that this information is not published. An internal database of charity trustees will also be maintained that will include trustee contact details.

The register will also be expanded to include copies of the annual accounts for all charities, which will not be redacted.

Separately OSCR will publish a list of trustees whom the Courts have removed and barred from acting as trustees in the future, and a register of charities who have merged will be maintained that will assist with the transfer of legacies.

OSCR’s powers

OSCR’s inquiry powers will be extended, allowing them to investigate former charities and former charity trustees. The Act also includes measures that should streamline the inquiry process. OSCR will also have the ‘power of positive direction’, meaning that in specific circumstances they will be able to direct charity trustees to take specific action.

If charities fail to submit their accounts, or if they do not engage with the regulator, then OSCR will have the power to remove them from the Scottish Charity Register.

Charitable status will be dependent upon maintaining a connection to Scotland. Applicants to the Register may be denied charitable status by OSCR if they cannot demonstrate such a connection, and existing charities could be removed from the Register on the same basis. These powers are not intended to affect genuine cross-border charities.

Trustees

The range of offences and circumstances that result in automatic disqualification of charity trustees are being extended, to include offences such as being convicted under bribery or proceeds of crime legislation, association with terrorist groups and sexual offences, and will also apply to those in senior management positions within a charity.

OSCR will be able to appoint interim trustees in specific circumstances.

Further guidance on these reforms will be published by OSCR in due course, including the timetable for their implementation.

Details: http://bit.ly/3m5KZkn

Annual return changes

OSCR has proposed several changes to the Annual Return required from Scottish Charities, with a consultation period on the changes which ran to 6 October 2023.

These proposals will require additional information to be provided, including a description of the activities undertaken by the charity and the number of trustees, staff and volunteers.

There will also be more questions on the governance of the charity that OSCR hope to be able to use in better providing guidance to trustees in helping them to meet their legal duties and ensure that the charity is being well run. It will also help OSCR to identify situations where regulatory action may be needed.

Details: https://bit.ly/3ZthZ5o

Internal controls

Having an effective system of internal control is a key way in which charities can protect themselves against risks that may arise and safeguard their resources. With the passage of time new risks will emerge and those systems will need to respond and adapt. To help charities with this process CCEW has updated its guidance in CC8 internal controls for charities.

The updated guidance is more concise and clearer than before. It covers issues that were not covered in the previous version, including those arising from newer technology such as the use of cryptoassets and mobile payment systems such as Google Pay and Apple Pay. Specific risks arising from the use of cryptoassets referenced in the guidance includes vulnerability to theft by hackers, volatility in the value of crypto currency, difficulty in tracing donors and a lack of regulatory protection. This update is particularly timely given that earlier this year the Department for Science, Innovation and Technology published research that showed that 24% of charities had experienced a cyber attack in the previous 12 months.

It’s not just risks resulting from technology that have been updated in the guidance, with more traditional areas such as holding public collections, making payments to related parties and operating overseas also being revised, and a new section on accepting hospitality has been added to the guidance.

Accompanying the guidance is an updated checklist for charities to use when checking whether their internal controls align with CCEW’s guidance, something charities should be checking at least annually.

Details: https://bit.ly/3LC8c79

Fundraising best practice

A common concern about the charity sector is that too little of the funds raised get spent on performing charitable activities. This issue was recently considered by CCEW when carrying out an inquiry into Hospice Aid UK which had a costly direct mailing agreement with a third-party agency, and discovered that substantial funds being generated were being almost entirely consumed by the direct costs and fees of running the activity, leaving only 6% of the sums raised available for spending on the charitable activity.

This case attracted the attention of the Fundraising Regulator, and in response has published five best practice considerations when working with external agencies.

- Act in your charity’s best interests, taking reasonable steps to assess and manage any risks involved, including potential reputational risks.

- Understand the standards that apply as set out in the Fundraising Code, and check whether the third party has registered with the regulator.

- Make sure third parties are monitored effectively to ensure that they are operating in line with the Fundraising Code.

- Consider the donor perspective and ensure that they can make informed decisions when giving to charity.

- Engage with the Fundraising Regulator for help and support.

Whilst the Fundraising Regulator does appreciate that a third-party needs to cover the costs and will seek to generate a reasonable profit, they do expect that the greater portion of money raised will be transferred to the charity. Trustees should ensure that this is indeed the case with any arrangements they enter into with external fundraising agencies so that they don’t attract the attention of the regulators.

Details: https://bit.ly/455lbVR

Code of Fundraising Practice consultation

The Fundraising Regulator has launched a consultation on proposed changes to the Code of Fundraising Practice.

There are two key themes set out in the proposals, to combine and amend the existing rules into principles-based rules, and to replace rules where the Fundraising Regulator is not the lead regulator with signposting of relevant legislation and guidance. They are also consulting on areas where the Code could be expanded upon to take account of recent developments, such as increasing use of cashless giving and cryptocurrency to make donations, the use of social media and improving protection for fundraisers.

Interested stakeholders have until 1 December 2023 to comment on the proposals.

Details: https://bit.ly/3ZCpTJF

Charity register update in Northern Ireland

CCNI is launching a new traffic light display that will indicate whether a charity has submitted its annual report and accounts on time. The new approach is due to be launched in December and will enable the public to easily see whether a charity has complied with its filing obligations. Charities that have filed late will have this highlighted with how many days late they filed. The use of the traffic light system will also make it easier to see where a charity’s annual filing is overdue. It is hoped that these changes will encourage charities to ensure that they make their annual filings within the 10 month deadline so to avoid the adverse publicity that comes from being behind with their obligations.

Details: https://bit.ly/3Prvxtz

Improving the quality of charity accounts

In the Spring 2023 edition of Charity News we reported that OSCR had performed a review of the quality of charity accounts submitted to them. One of the main issues they noted was a failure to include an accompanying trustees’ report that complied with relevant requirements.

This has now been followed up with some guidance issued by OSCR on how to prepare a good trustees’ annual report. Much of this merely signposts existing guidance , but they have set out some of the benefits that a good quality report can bring.

The guidance highlights that by demonstrating public accountability and transparency a charity can indicate that good standards of governance are being applied which provides greater assurance to stakeholders and ultimately can encourage funders to support the charity.

Separately OSCR has also provided new guidance on the need for charity accounts to include comparative information and highlighted some of the common disclosure areas that accounts often omit, which include key disclosures related to trustee remuneration and other related party transactions.

It’s not just in Scotland that issues have been found with charities failing to properly meet their reporting obligations. In May 2023 the CCEW published details of ‘double defaulters’, charities that have failed to submit their annual return and accounts for two or more years in the last five years and had previously been given final warnings to comply by a specified date but had failed to do so, resulting in CCEW commencing an inquiry process into them.

Most of the time this inquiry process results in charities getting their reporting obligations up to date, but in 15 cases it revealed that the charities were not operating or had ceased to exist and were removed from the Register, and in a further 6 cases serious regulatory concerns were identified and separate inquiry proceedings were opened to review how those charities operated.

Charities need to be aware that regulators do make use of the annual reports filed with them, or the lack of such reports, in carrying out their oversight of the sector and thus it pays for charities to ensure that they are compliant with their annual reporting obligations and meet all filing deadlines.

Details: bit.ly/3thneZZ

bit.ly/46glLl8

bit.ly/3PGkJb1

Tax consultations

On Tax Administration and Maintenance Day earlier this year two consultations were launched of particular relevance to the charity sector.

Firstly there was the announcement of the Government’s future engagement with stakeholders on reforming Gift Aid. It is understood this will involve assessing how administrative burdens can be eased through the use of digital technology, as well as developing new ways to test future Gift Aid development ideas using digital sandboxes.

The second consultation related to tax compliance, and plans for ‘reasonable and proportionate’ changes to reform tax relief rules that will supposedly help tackle non-compliance and protect the integrity of the sector. Four areas are being considered as part of the consultation:

- Preventing donors from obtaining a financial benefit from their donation and the operation of the Tainted Charity Donations rules

- Preventing abuse of the charitable investment rules

- Closing a gap in non-charitable expenditure rules

- Sanctioning charities that do not meet their filing and payment obligations.

Both consultations have now closed and we await announcement from HMRC of what changes to the tax regime they propose to make, details of which will be covered in future editions of Charity News.

Details: bit.ly/46jb80U

Charity rates relief

Charitable organisations in England can obtain a mandatory 80% reduction in business rates on any property it occupies and uses wholly or mainly for charitable purposes, with local authorities able to offer a further 20% discretionary relief. A recent Supreme Court case (London Borough of Merton v Nuffield Health) has confirmed the test for eligibility for this relief. The case hinged on whether a local authority could apply a local public benefit test at each individual site, distinct from the charity law test applicable to the charity’s operations overall, as regulated by CCEW.

Fortunately in this case the charity won the day, and the judgement avoided the potentially confusing situation that could arise where local authorities could determine what constitutes public benefit, preserving charity law’s jurisdiction over this issue. As a result any registered charity will be able to claim mandatory rates relief on any property “wholly or mainly used directly for activities which constitute the carrying out of the charitable purposes of the charity or, by a modest extension, for activities which directly facilitate or are wholly ancillary to the carrying out of those purposes”. This will include properties used for activities such as fundraising, head office management, investment and the provision of staff accommodation.

The Court in reaching its decision also helped clarify some issues surrounding what constitutes public benefit which have a more general application, particularly for charities that operate across multiple sites.

For those interested in this case a more detailed analysis has been published by the Charity Tax Group.

Details: bit.ly/46gzMiO

How we can help

We have a strong team of compliance experts who are experienced in performing audits and independent examinations of charities reporting under the Charities SORP, community benefit societies and companies limited by guarantee. As well as our specifically trained accountants and auditors, our team includes specialists who understand the more complex tax challenges that the charity sector faces in relation to VAT, including partial exemption and corporation tax.

If you’d like to speak to our team about how we can help your charity, or you if you have any queries relating to the contents of this document, please get in touch.

Download your copy of our Autumn 2023 Charity News Update on the button below.

Download the PDFDeal Dispatch – Issue 42

Welcome to issue 42 of Deal Dispatch, our corporate finance division’s regular deal round-up.

Overview

Last year PKF ranked as the 7th most active dealmaker in the UK, completing 139 deals worth £2.3bn. In the Midlands we completed 29 deals, including 5 cross-border deals, worth £346.8m. We were also shortlisted for ‘SME Advisory Team of the Year’, amongst others, at the Insider Midlands Dealmakers’ Awards in September 2023.

This year’s corporate finance activity has been more challenging than 2022, however, we recently completed 4 deals in 2 weeks showing that deal activity remains possible for good quality businesses.

Inside this edition

Private equity bolt-on

Solihull-based Evac+Chair International has acquired ProMove UK Ltd in a deal supported by the Midlands division of PKF Corporate Finance.

Management Buyout of QEP-UK

QEP-UK, the home of leading tiling, flooring and hardware home improvement brands such as QEP®, Roberts®, Vitrex®, Tile Rite®, Plasplugs®, Homelux®, XPS Foam™ and Kraus®, has been acquired in a management buyout with specialist support from PKF advisory, tax and corporate finance teams.

Sale of Griffiths Waite to an Employee Ownership Trust

Award-winning technology consultancy firm Griffiths Waite has been sold to an employee ownership trust (EOT) in a deal led by the transactions tax team at PKF Smith Cooper.

New senior executive joins PKF corporate finance as Midlands division grows

Our award-winning PKF Corporate Finance team has hired a new senior executive, Callum Leslie, as we continue to fuel our ambitious expansion plans for growth through ongoing recruitment efforts.

Click below to view issue 42 of Deal Dispatch. If you would like to discuss your growth or exit plans, our corporate finance team have a wealth of knowledge and experience advising a variety of businesses. Please do not hesitate to get in touch today.

Download the PDFDeal Dispatch – Issue 41

Welcome to issue 41 of Deal Dispatch, our corporate finance division’s regular deal round-up.

Inside this edition

Acquisition of Barack Group of Companies by FT Foods Limited

The multi-award-winning Tahir Group has become the largest KFC operator in London after acquiring eight KFC restaurants, previously operated by the Barack Group of Companies, in a deal managed by PKF Smith Cooper Corporate Finance.

Sale of Hyperama Nottingham and West Bromwich Ltd to Dhamceha Foods Limited

The Corporate Finance team of PKF Smith Cooper has advised Midlands-based Hyperama plc on the sale of its cash and carry division to London-based Dhamecha Group. Hyperama’s Nottingham and West Bromwich depots will bolster Dhamecha’s presence in the Midlands, boosting the number of its cash and carry branches to 12 post completion.

Sale of Gunn JCB Midlands division to Midlands JCB

Gunn JCB has sold its Midlands division, operating principally from depots in Smethick, Stoke-on-Trent and Hereford, to Midlands JCB in a deal assisted by PKF Smith Cooper.

Acquisition of Powrmatic by Carver Group

Carver Group is a family owned business managing a portfolio of HVAC companies specialised in refrigeration technology, air conditioning technology and ventilation technology. The Group headquarters are in the UK and the company has representation in 50 countries and branches in Germany, France, the Netherlands, United Kingdom and Canada.

Click below to read issue 41 of Deal Dispatch. If you would like to discuss your growth or exit plans, our corporate finance team have a wealth of knowledge and experience advising a variety of businesses. Please do not hesitate to get in touch today.

Download the PDFSector insight – Self-storage 2023

With the UK market expected to surpass a record £1 billion in turnover in 2023 and an additional 2 million square feet of space occupied compared to the prior year, the self-storage industry is continuing to flourish in terms of both capacity and geographical distribution.

Following the industry benefitting from positive impacts of the pandemic, this year has been increasingly reflective of the challenges the market is facing as a result of heightened inflation and growing operational costs. Despite the more challenging economic environment, the sector has continued to outperform many other industries, with companies benefitting from stable occupancy and an increase in revenue per square foot.

Self-storage sector insight

Our latest self-storage sector insight includes an overview of the UK market, including how it compares to the international market, an analysis of supply and demand in the industry and recent merger and acquisition activity, as well as looking ahead at the future of the self-storage industry.

Supporting business owners through complex transactions

As a valued member of the Self Storage Association UK, our team supports owners, operators and investors in the self-storage industry in three main ways:

- Advising owners on the sale of their self-storage business

- Advising clients on acquiring self-storage businesses

- Advising clients on accessing debt or investment to fuel growth

If you would like advice about disposals, acquisitions, or fundraising opportunities in the self-storage sector, please get in touch with our expert corporate finance team for a conversation about your options.

Download the PDFCharity news update – Spring 2023

Our Spring 2023 charity news update includes the latest guidance and support available for the not-for-profit sector as the cost of living crisis continues to bite.

Inside this edition

We also consider the impact of recent legislative, reporting and tax developments and other pertinent issues, giving you the inside track on the sector’s current hot topics and latest guidance. Our Spring 2023 charity news update explores:

- Charities and the continuing cost of living crisis

- Charity law reform

- Annual return changes

- Use of social media

- The risks from cyber crime

- Other charity guidance

- Charities in Northern Ireland

- Future changes to financial reporting

- Improving the quality of charity accounts

- Fundraising update

- Spring Budget 2023

- VAT update

How we can help

We work with a range of charities, varying in size and nature – from the very small to more complex groups of entities. This means we can provide bespoke advice on how to achieve your goals and navigate the complex web of regulation.

We have a strong team of compliance experts who are experienced in performing audits and independent examinations of charities reporting under the Charities SORP, community benefit societies and companies limited by guarantee. As well as our specifically trained accountants and auditors, our team includes specialists who understand the more complex tax challenges that the charity sector faces in relation to VAT, including partial exemption and corporation tax.

If you’d like to speak to our team about how we can help your charity, or you if you have any queries relating to the contents of this document, please get in touch.

Download the PDFYour guide to PKF VAT Assist

What is PKF VAT Assist? You may have heard of our VAT consultancy service that launched earlier this year, but how exactly can it benefit you and your business? Our new brochure explains how the service works.

Our PKF VAT Assist brochure provides a concise but comprehensive overview of our VAT consultancy service. Created by our team of VAT & Indirect Tax specialists, the publication also explains the benefits that on-demand VAT & Indirect Tax support can bring to individuals and businesses in a range of sectors.

Whether you are looking for a bespoke advisory service or want to subscribe for longer term support, PKF VAT Assist offers direct access to specialist advice from our experts on all your VAT & Indirect Tax queries.

For more information on the consultancy helpline and our service packages, including costs, contact our team on 01332 374 432 or by emailing [email protected].

Download the PDF