We have recruited two experienced tax professionals into new director roles, bolstering our specialist credentials in capital allowances and employment tax services, as our team expansion plans continue.

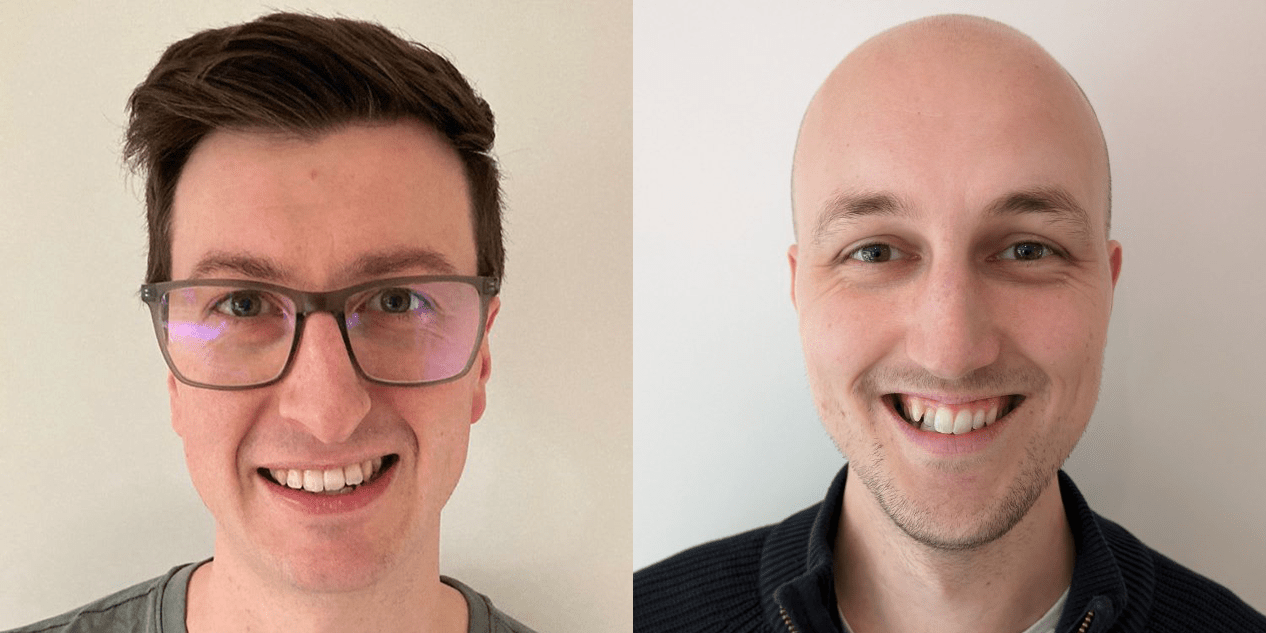

Jack Bonehill, winner of Tolley’s Taxation Rising Star award 2023, steps into the role of Employment Tax Director, and Sam Parker-Hully adds over 10 years’ specialist experience to our tax team as Capital Allowances Director.

Jack Bonehill has spent nine years specialising in employment tax, including seven years working at a leading Midlands accounting firm. In 2020, Jack launched ‘The Tax Professionals Podcast’ to provide professionals in the tax industry with career support and guidance, and in 2023, he won Tolley’s Taxation Rising Star award in addition to being shortlisted for their Tax Mentor of the Year award.

Jack is experienced in helping businesses across the Midlands and surrounding areas manage their employment tax obligations and has specialist experience in the recruitment, logistics and construction sectors. In his new role, Jack will support our clients with all areas of employment tax.

Sam joins us with over 10 years of capital allowances experience from two Big Four companies. As director, Sam will help our clients and contacts unlock and maximise tax relief on fixed asset expenditure, which will include advising on more complex areas of capital allowances related to the construction, refurbishment and acquisition of commercial property.

Sam’s wealth of experience includes advising some of the biggest businesses in the country across a variety of different industries. He has handled a diverse range of projects, from setting up office fitouts and warehouse constructions to overseeing large-scale infrastructure projects.

Jack said: “Since joining the tax team at PKF Smith Cooper earlier this month, I have been getting stuck into supporting our clients with their employment tax obligations and I am looking forward to further developing my tax leadership skills in this new role. One of the main reasons I joined PKF Smith Cooper was that they had a lot of young people in leadership positions, which was reassuring to me that my age wouldn’t be used as a reason to hold me back.”

Sam said: “I am excited to start a new journey at PKF Smith Cooper as Capital Allowances Director, where I will be able to offer my expertise to current and future clients and contacts of the firm. I look forward to guiding them through claims for capital allowances, an increasingly valuable area of tax relief.”

Gary Devonshire, Tax Advisory Partner at PKF Smith Cooper, commented: “We are pleased to have Jack and Sam on board at PKF Smith Cooper and we know that their skills and expertise will make them crucial members of our growing team, for the benefit of both colleagues and clients in our core Midlands markets.”

“We are also delighted that our enhanced capital allowances and employment tax services will allow our tax advisory division as a whole to continue to grow and add to the exceptional growth we have seen in the last few years. These hires demonstrate the firm’s investment in tax and our growth plans also provide opportunities for interested tax experts who could be an asset to our firm.”

Gary Devonshire

Following a successful 2023, which included being shortlisted for ‘Best Tax Practice in a Regional Firm’ at the esteemed Tolley’s Taxation Awards, the PKF Smith Cooper tax division is continuing to grow and strengthen the expert team behind our compliance and advisory services with an ongoing recruitment push.

If you are looking for your next career move in the tax industry, you can view our current vacancies here.